We make investing in precious metals simple, secure, and reliable.

Global Bullion LLC is your premier destination for high-quality precious metals. We specialize in providing gold, silver, platinum, and other investment-grade bullion with secure, fully insured and free worldwide delivery. Whether you’re an investor or collector, trust us for competitive pricing, authenticity, and exceptional service.

Featured Mints

Why Choose Global Bullion LLC?

Established in 2009, Global Bullion LLC is a trusted online retailer specializing in physical precious metals. We deal exclusively in gold and silver bullion, ensuring that every order is securely packaged and delivered directly to your door.

Quality is our top priority. We source our inventory directly from leading mints and authorized distributors, carefully inspecting each product to guarantee authenticity, purity, and excellence. Our customers can invest with confidence, knowing they are receiving only the highest-quality bullion.

Global Bullion LLC operates from 400 Sunrise Hwy, Massapequa Park, NY 11762, United States. We are fully accredited by state and federal authorities, as well as recognized by major distributors in the precious metals industry.

Customer satisfaction is at the core of our business. Whether you have questions about a new order, a shipment in progress, or a past purchase, our dedicated support team is ready to assist. You can reach us via phone, live chat, or email, and we will respond promptly to ensure a smooth and seamless experience.

At Global Bullion LLC, we make investing in precious metals simple, secure, and reliable.

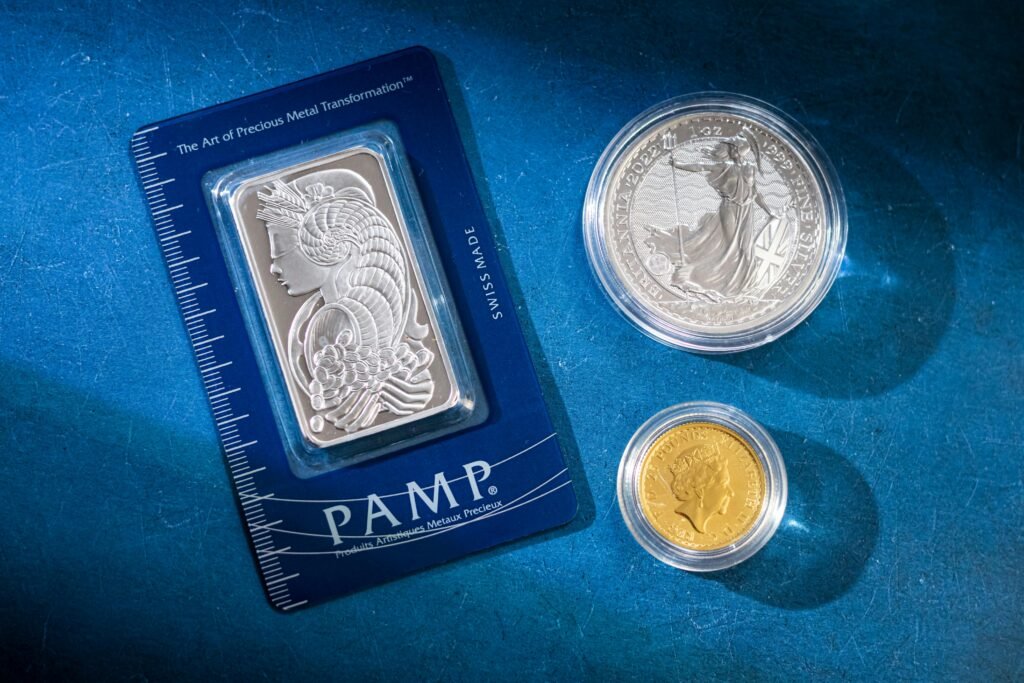

Featured Bullion

A Trusted Leader in Precious Metals

Over the past decade, Global Bullion LLC has grown into an industry leader in the precious metals sector. We are proud members of the Numismatic Guaranty Corporation (NGC), Professional Coin Grading Service (PCGS), ANACS, and the Industry Council for Tangible Assets (ICTA), as well as the prestigious Silver Institute. Additionally, we are authorized dealers for the United States Mint, Perth Mint, and Royal Canadian Mint.

Our commitment to excellence is reflected in our five-star rating on Google, A+ accreditation from the Better Business Bureau (BBB), and our status as a fully licensed, bonded, and insured company. These credentials and industry recognitions set Global Bullion LLC apart as a trusted name in the precious metals market.

Setting the Standard in Precious Metals with Excellence, Trust, and Industry Recognition

We proudly supply authentic bullion from all major mints across the globe, with free and fully insured worldwide shipping. Simply send us your inquiry—leave the rest to us. Fast, reliable, and trusted delivery every time.

Your investment is our priority—buy with confidence, invest with trust!

We are a world-class leader in bullion sales, specializing in gold, silver, platinum, and investment-grade bullion. We cater to all requests, providing secure, fully insured, and free worldwide delivery. Whether you’re an investor or collector, we offer competitive pricing, authenticity, and exceptional service—just one step away.

Simply send us an inquiry and leave the rest to us. With direct sourcing from top mints, fully insured global shipping, and a commitment to excellence, you can trust us for secure and seamless transactions.