Successful Bullion Investors: Case Studies and Insights

Explore the intricacies of bullion investments through compelling case studies of successful investors like John Templeton and central banks. Understand how tangible assets like gold and silver can hedge against inflation and market volatility. Learn strategic insights on investing in bullion, including the use of gold ETFs for ease and liquidity.

Introduction to Bullion Investments

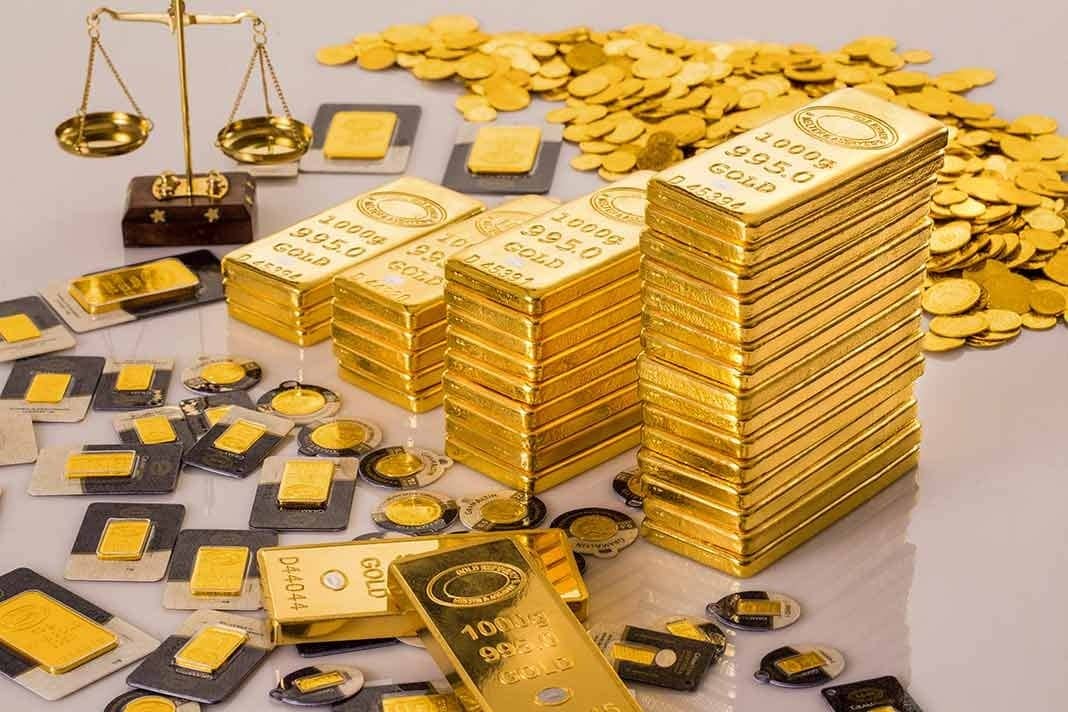

Investing in bullion has long been considered a safe haven during times of economic uncertainty. Bullion, which includes precious metals such as gold and silver, offers a tangible asset that can hedge against inflation and currency fluctuations. This blog post delves into case studies of successful bullion investors, providing insights and strategies that have led to their success.

Case Study 1: John Templeton’s Strategic Investment

John Templeton, known for his value investing approach, capitalized on the potential of gold during periods of market downturns. In the early 2000s, when the stock market was highly volatile, Templeton increased his holdings in gold bullion and gold mining stocks. This strategic move not only preserved his wealth but also yielded significant returns when gold prices surged. His ability to foresee market trends and act decisively showcases the efficacy of strategic bullion investment.

Case Study 2: The Consistent Performance of Central Banks

Central banks around the world have consistently held and increased their bullion reserves. For instance, countries like China and Russia have been systematically accumulating gold to diversify their reserves and protect against geopolitical risks and dollar devaluation. This practice underscores the long-term reliability and importance of bullion in preserving national wealth and financial stability.

Case Study 3: Private Investors and Gold ETFs

Private investors have also successfully navigated the bullion market through gold exchange-traded funds (ETFs). By leveraging the liquidity and ease of access offered by ETFs, investors can gain exposure to bullion without the complications of physical storage. Many investors have built substantial portfolios by systematically investing in gold ETFs, thereby achieving stability and growth amid market volatility.

Conclusion

These case studies highlight different strategies employed by successful bullion investors, ranging from strategic market timing, consistent accumulation, to utilizing modern financial instruments like ETFs. Understanding these approaches provides valuable lessons for any investors looking to diversify their portfolio and safeguard their assets through bullion investment. The success of investors like John Templeton and central banks reinforces the significance of bullion in crafting a resilient investment strategy.